Deep Dive: Alphabet Inc. ($GOOG) Part 2

Undervalued Based on Sum of Parts Valuation

Welcome to Rebound Capital. Here we conduct deep research into beaten-down stocks and study companies that made a successful comeback. Subscribe for free and join 5,800 other investors to make sure you don’t miss our next briefing:

Alphabet: What is a Great Business Worth?

In Part 1 of the Alphabet Deep Dive, we established that Alphabet has a superior business model and is expected to lead the AI revolution. They are leaders across all three pillars of the AI ecosystem: models, hardware, and distribution.

Even the best businesses can be a poor investment if you buy it at the wrong price. So, what is a good entry point? For a company with multiple, diverse business segments like Alphabet, a "sum of parts" valuation is a great way to figure out what the company is truly worth.

This approach involves valuing each segment individually before combining them for a total company value. This is more accurate than using a single valuation model like a Discounted Cash Flow (DCF), which can miss key details in a complex business.

I use a comparable analysis, which is like valuing a house based on the price per square foot of similar homes in the same neighbourhood. This method allows me to benchmark each of Alphabet's segments against similar, publicly traded companies.

I am also sharing the full valuation sheet with all the assumptions so that you can tweak it however you see fit!

How to do a Comparable Valuation using EV/EBIT multiples

Here is how we can perform a comparable valuation using EV/EBIT multiples:

Project Future Profitability: First, I estimate how much revenue and profitability (measured as EBIT, or Earnings Before Interest and Taxes) each business segment will generate by the year 2030.

Calculate Enterprise Value (EV): Next, I determine the Enterprise Value (EV) for each segment in 2030. Think of the EV as the total price tag of a business, representing what a company is worth to all of its investors, including shareholders and creditors.

I find this value by multiplying a segment’s EBIT by its "EV/EBIT multiple," which is a ratio that helps compare its profitability to the value of similar companies in the market. For example, if a company ABC is worth $100 (EV) and its EBIT is $10, its EV/EBIT multiple is 10. If I want to value another company, XYZ, with a similar business model, I can use the same EV/EBIT multiple. If XYZ's EBIT is $50, its EV would be $500 ($50 x 10).

Discount to Present Value: Because money today is worth more than the same amount in the future, I "discount" that 2030 value back to today's terms. I use a 5% discount rate to account for this change over time, giving me the current value of each segment in 2025.

Sum the Parts: Finally, I sum up the individual values of each segment to get the total value of the company.

This approach accounts for the unique growth and margin profiles of each business, providing a more detailed valuation and allowing me to easily change assumptions.

Alphabet Sum of Parts Valuation Steps

To value Alphabet, I perform a sum-of-the-parts analysis by following these steps:

I estimate each of Alphabet's business segments' future revenue and profitability (EBIT) through the year 2030.

I then apply an EV/EBIT multiple to each segment's estimated 2030 EBIT to determine its Enterprise Value (EV).

I "discount" each segment's 2030 Enterprise Value back to its present value in 2025 using a 5% discount rate.

By summing up the present values of each individual segment, I get the total valuation for Alphabet.

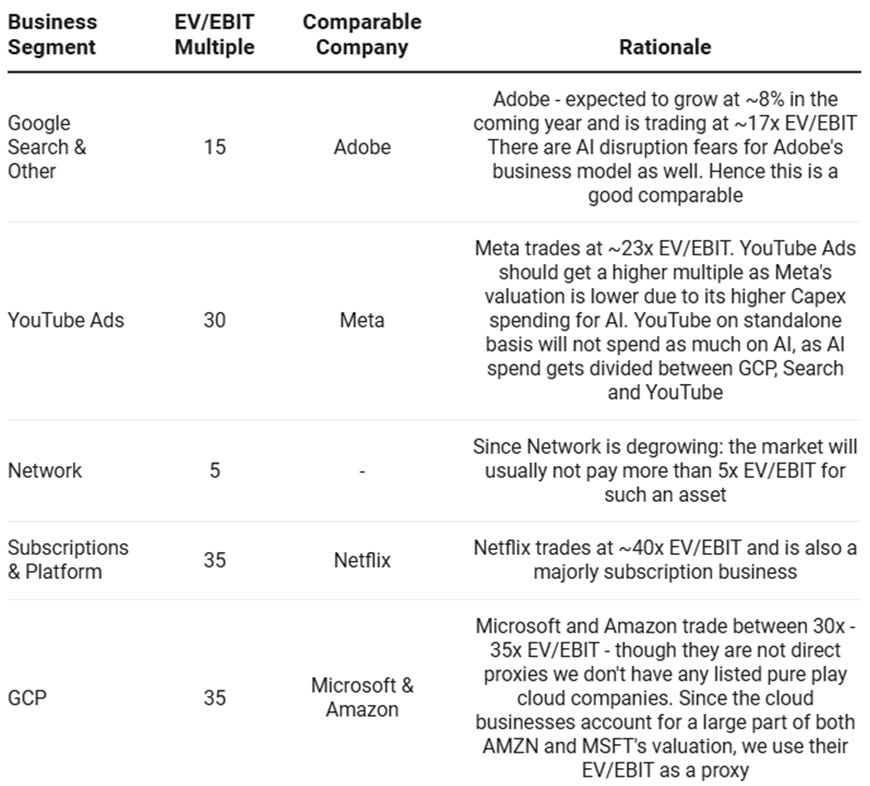

The rationale for the EV/EBIT multiples taken for different business segments is as follows:

Segment-by-Segment Analysis

1. Google Search & Other and Google Network

These two core advertising businesses are analyzed together due to their combined role in Alphabet's advertising ecosystem.

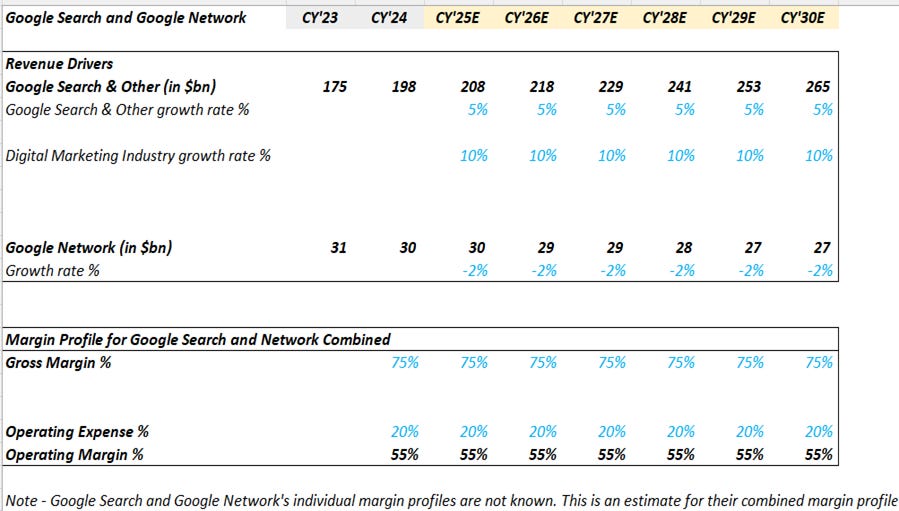

Revenue Growth Estimates: Revenue to grow from $198B in 2024 to $265B in 2030 for Google Search and from $30B in 2024 to $27B in 2030 for Google Network.

The digital marketing space is expected to grow at ~10% per annum. The model projects a conservative annual growth rate of 5% for the Google Search & Other business. This assumption is based on the rationale that increasing competition from new generative AI search experiences (like those from OpenAI and Perplexity) may lead to a slower growth trajectory for traditional search.

Conversely, the Google Network business is projected to degrow at 2% annually. This reflects the trend of Google prioritizing its own properties over third-party publisher sites as new AI features increasingly satisfy user queries directly, reducing the traffic that traditionally drives Google Network revenue.

Profitability Estimates: The combined segment is modelled with a consistent gross margin (GM%) of 75% and an operating expense (OpEx) of 20% of revenue. The high gross margin reflects the low variable costs of the core search business. The Traffic Acquisition Costs disclosed by Alphabet in SEC filings have been used as a proxy for the cost of revenue for the Search and Network Segment. The cost of revenue is ~25% of revenue, giving a GM% of 75%.

The OpEx accounts for the substantial R&D and SG&A expenses required to maintain its market-leading position. Around half of Alphabet’s Operating Expense has been allocated to this combined segment, as these two segments are >50% of Alphabet's revenue (this is a Rebound Capital estimate, and Alphabet does not give this segment-level data).

Finally, for the sum of parts calculation, I assumed that Google Search has 55% operating margin (as derived) and that the Network business is at 35% operating margin. The 35% margin number is an estimate, considering the expected lower profitability of the Network business as it is dependent on third party users, who need to be paid substantial amounts.

2. YouTube Ads

YouTube's ad revenue is a critical, high-growth component of Alphabet's business. Revenue is expected to grow from $36B in 2024 to $61B in 2030.

Keep reading with a 7-day free trial

Subscribe to Rebound Capital to keep reading this post and get 7 days of free access to the full post archives.