Notes on Copart and AMD

Research updates on 2 potential rebound candidates

We are publishing this without a paywall.

Hi there,

One of the most frequent requests from our readers was to cover more companies and industries. With the scaling up of the Rebound Portfolio and our team (all thanks to you!), we are in a great position to do exactly that.

Starting today, we will post frequent notes on specific industries or companies we are researching. Unlike our deep dives, this will be much shorter, and you can consider it a starting point for your research or an intro to interesting companies and ideas. With notes, we will also cover macroeconomic developments that can create rebound opportunities.

Copart Inc ($CPRT)

Copart is a ‘leading global provider of online auctions and vehicle remarketing services’ in their own words. It began in 1982 as a single salvage yard and has since grown into a dominant global digital marketplace selling more than 4 million vehicles annually.

Unlike a traditional used-car dealer, Copart rarely takes inventory risk. It operates as a 2 sided marketplace:

Supply: Over 80% of its vehicles come from insurance companies that have declared a car a ‘total loss’ after an accident or natural disaster (hurricanes).

Demand: Copart connects sellers to a global base of 1 million buyers - dismantlers, rebuilders, and exporters through its proprietary platform called VB3 (Virtual Bidding 3rd Generation).

Revenue is primarily fee-based (auction fee, storage, and logistics fees). Copart earns high margins as a marketplace, with >35% operating margins in the last 5 fiscal years.

Copart has been an exceptional compounder for investors over the last 20 years, delivering a ~18% CAGR (>25x returns) vs. a 10%-11% return for the S&P 500.

Welcome to Rebound Capital. If you are new here, we conduct deep research into beaten-down stocks and study companies that made a successful comeback. Subscribe for free and join 15,400 other investors to make sure you don’t miss our next briefing.

The vehicle salvage industry in the US is a duopoly between Copart and RB Global’s IAA, which makes this an attractive sector for investors (due to low competition).

Copart has a strong moat protecting its high profits:

Owns 90% of the land used for junkyard operations

Copart owns more than 20,000 acres of land (250+ physical locations) globally. Zoning for junkyards is tough in today’s regulatory environment, especially in and around major city centers. The ‘Not in my Backyard’ effect makes it very difficult for any new competitor to buy land.

This physical infrastructure also enables Copart to respond swiftly to natural disasters such as hurricanes, which often leave large numbers of damaged vehicles. Owning land protects Copart from rent inflation and reduces its cost structure, resulting in structurally higher operating margins vs its competitors.

Marketplace Flywheel

As the largest digital marketplace for vehicle auctions, Copart can command the highest prices for its suppliers (due to intense bidding competition for vehicles). Getting the best price for their inventory increases the number of sellers on Copart’s platform, which in turn increases the number of bidders - a virtuous cycle.

What Went Wrong

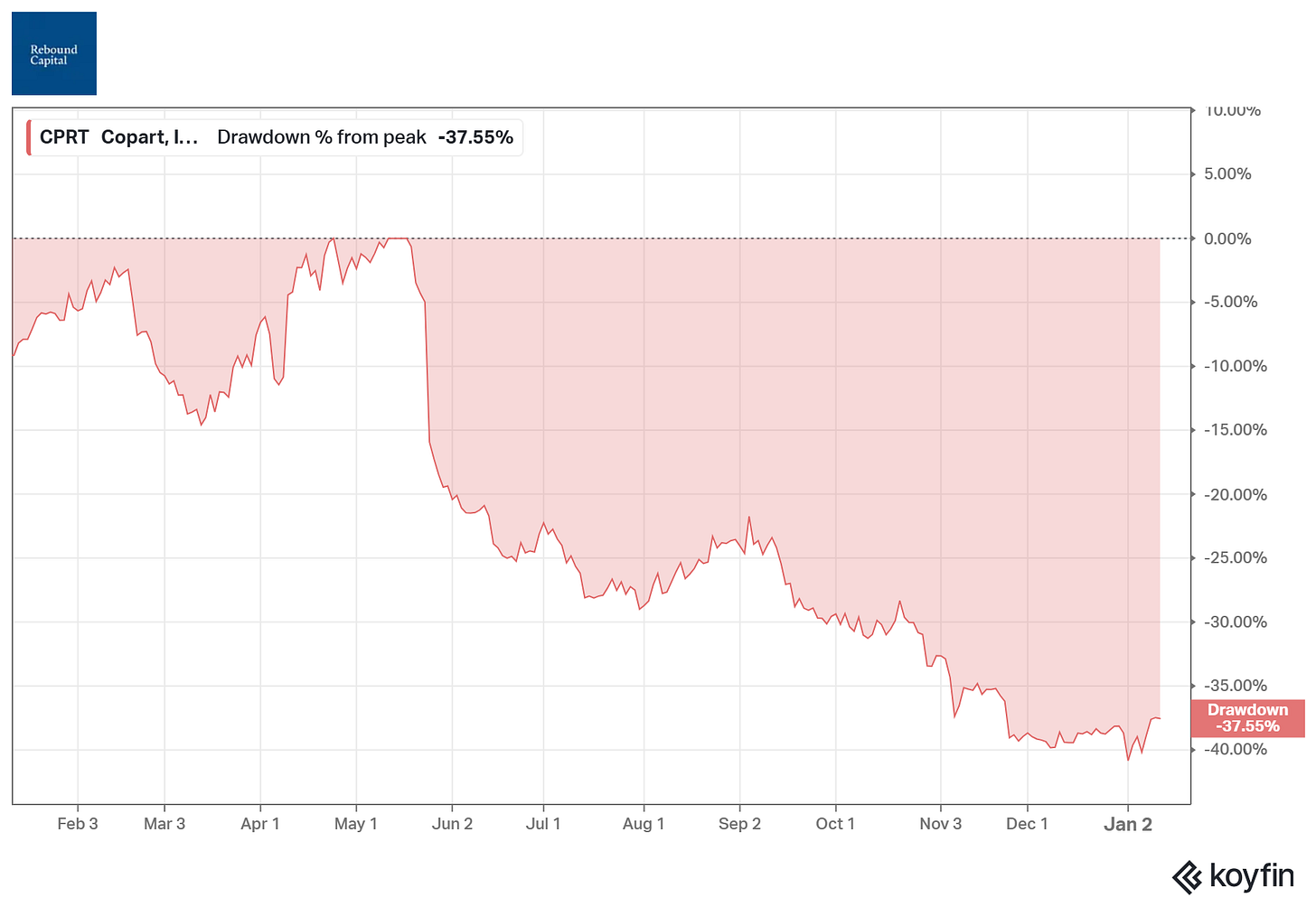

Copart is down ~37% from its recent peak. In May 2025, the stock dropped 12% following the earnings release, as it missed operating margin and revenue growth expectations; revenue grew 7.5% YoY, below the double-digit growth rates investors had expected. It was expensive at a ~40x PE ratio, and the revenue growth miss led to a decline in the stock price.

The management also clarified that a major national insurance carrier had shifted a portion of its vehicle volume away from Copart to its rival, IAA - which has become more aggressive in winning business under its new management.

The stock declined further, post the Q4’FY25 earnings report, due to revenue growth slowing to ~5% YoY. This was driven by a lower volume of cars being sold on the platform.

Assessing Copart using our QGV Framework

We analyzed Copart using our QGV (Quality, Growth, and Value) framework.

Quality: Copart is a quality company. It has a wide moat and is the market leader in an attractive industry (with a duopoly structure). It has maintained a high ROIC (>25%) over the past 5 years, with an operating margin > 30%.

Growth: Copart has grown its revenue by ~10%, 16%, and 15% over the last 3, 5, and 10 years, respectively. The 2021-2022 period was an outlier, with revenue growth of 22% and 30%, respectively, driven by a rapid increase in the average selling price (ASP) of used cars during the pandemic (a significant portion of Copart’s revenue is linked to the ASP of vehicles sold). The shift to a high single-digit revenue growth (7%-10%) is a more sustainable level.

The downside risks to revenue growth are:

Lower used-car prices: Copart’s fees are directly linked to the used car market - because its core fee structure is percentage-based (with tiers). Used car prices may decline over the next 5 years, compared with the growth observed over the last 5 years. Though more volumes can offset lower prices, the risk remains.

Terminal value risk from autonomous vehicles: There are possible long-term headwinds from autonomous vehicles reducing accidents. Now, I know that over the last few decades, the Total Loss Frequency (the percentage of vehicles involved in accidents that are declared a ‘total loss’ or ‘totaled’ and which are not economical to repair) has trended upwards, negating the effect of lower accident frequency - but this is a terminal value risk. We are still seeking data that definitively shows that, over the next 5-10 years, the Total Loss Frequency won’t trend downward. Even if it remains constant, revenue growth will be hampered.

Short-term negative catalysts persist: We are not yet sure when the short-term headwinds to unit volumes will end (the stock price may continue to decline during this period).

Value: For a ~10% earnings CAGR stock with many potential negative catalysts, ~20x EV/EBIT is not value territory. If the valuation drops further, we will be interested. Even the management is not buying back stock at these levels.

Rebound Catalysts

At this juncture, we don’t see any catalysts that could increase the growth rate to a double-digit CAGR in the coming years - hence, we do not see any reason for a meaningful rerating of the stock to a 30x PE ratio. Therefore, all returns must come from earnings growth (which has meaningful downside risks).

Advanced Micro Devices ($AMD)

We last updated our subscribers on AMD in October, when we advised selling the stock after a ~60% return in just 3 months since our buy rating. Below are the material updates affecting AMD.

1) Key updates about the AI supply chain: A Potential Server CPU shortage?

Recent reports and early-2026 industry developments indicate that the adoption of ‘Agentic AI’ may drive increased CPU usage. While Generative AI primarily relies on GPUs for parallel processing, Agentic AI requires far more computational effort from CPUs to handle the complex orchestration of workflows and reasoning.

Why Agentic AI requires more CPU:

Orchestration of Tasks: CPUs act as the brain that will decide what tools to call, which tasks to perform in which order, and monitor the Agent’s progress towards a goal.

Latency during Tool Calling: In an agentic workflow, CPU latency can account for up to 90% of the agent’s overall latency. Hence, the CPU is now critical for Agents to complete work on time.

Continuous Operations: Agents may often run 24/7, necessitating always-on Server CPUs.

The above factors are setting the stage for a sustained increase in demand and prices of Server CPUs.

On 13th January, KeyBanc upgraded AMD and Intel on surging hyperscaler demand. The analysts note that, during recent channel checks, both AMD and Intel’s Server CPUs are sold out for 2026. In fact, they estimate that AMD’s server business may double in 2026 - implying strong ASP increases.

2) Analyst Day in Nov 2025: Bold Guidance from a Conservative Management

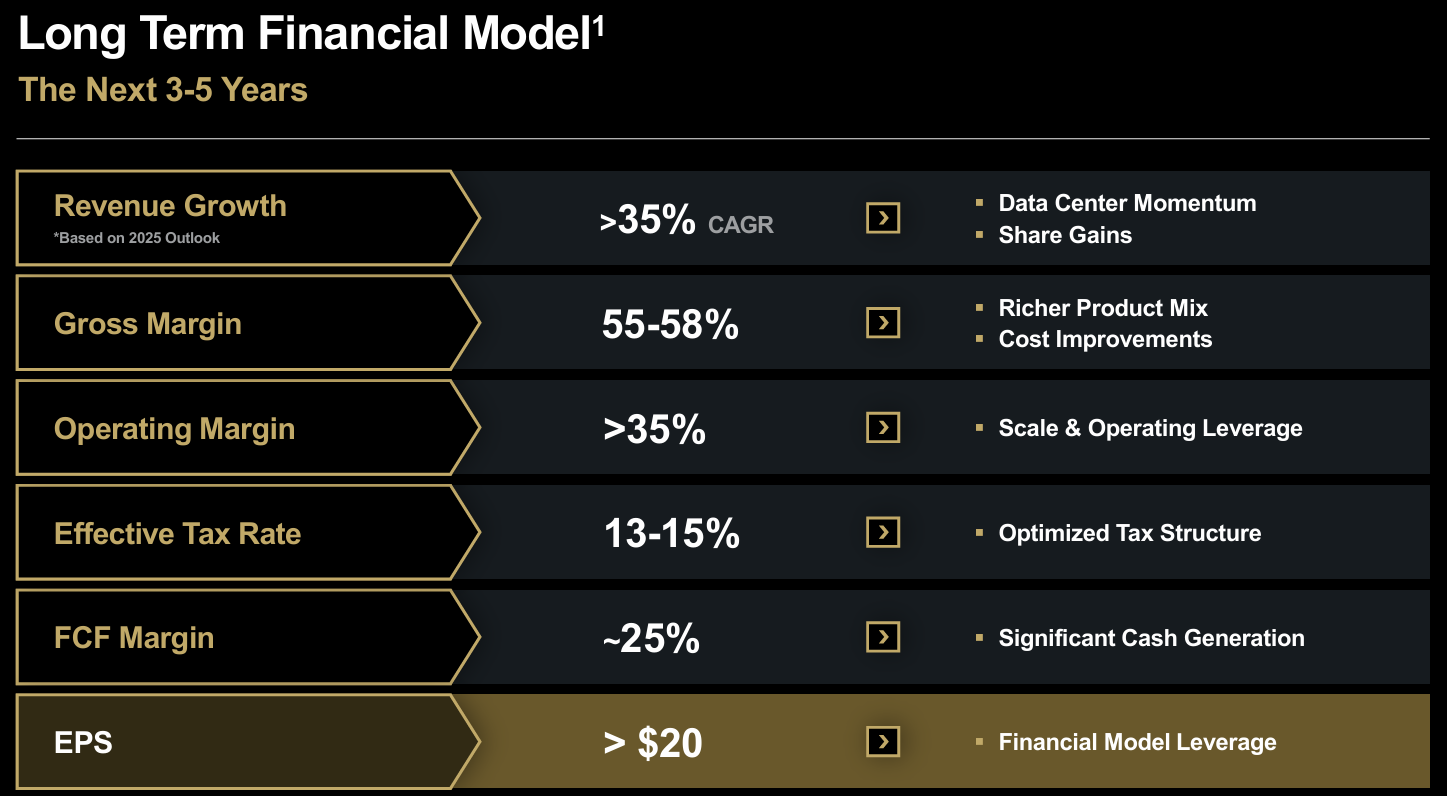

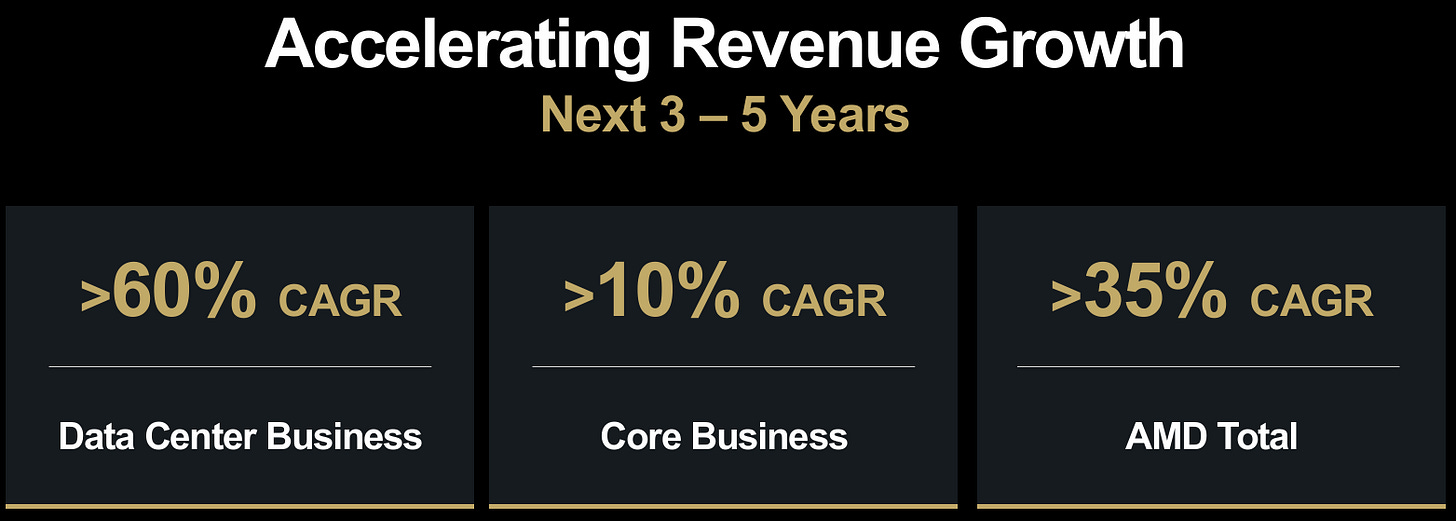

Management has indicated substantial revenue and profit growth over the next 3-5 years, signaling high confidence in its Instinct (GPU) and EPYC (CPU) roadmaps. Historically, Lisa Su has guided conservatively - lending credibility to this strong guidance. The market is currently skeptical that AMD can achieve these numbers and, hence, is pricing AMD at ~11x next 3-5 years’ EPS (according to guidance).

Long Term Financial Targets: Management guided to >$20 in EPS in the coming 3-5 years, driven by the Datacenter (DC) segment growing by >60% CAGR in the coming 3-5 years and improving Gross and Operating Margin.

Strong Guide for the DC Segment: Guide for >60% DC revenue growth with >80% DC AI revenue growth CAGR.

Software Momentum: Disclosed that there was a 10x YoY increase in ROCm software - this shows that even though Nvidia dominates the GPU software layer with CUDA, AMD is gaining traction.

We will post an update on AMD for our paid subscribers soon. Although AMD is not in a significant drawdown and is valued fairly, there could be substantial upside if the GPU business meets management’s guidance.

That’s it for now. If you are here, please “♡ Like” this piece. It helps us massively!

This work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research

As a developer, I would like to offer my view here:

>Why Agentic AI requires more CPU:

>Orchestration of Tasks: CPUs act as the brain that will decide what tools to call, which tasks to perform in which order, and monitor the Agent’s progress towards a goal.

= In agentic task like coding, LLM decides which tool to call. CPU just executes instructions from LLM.

>Latency during Tool Calling: In an agentic workflow, CPU latency can account for up to 90% of the agent’s overall latency. Hence, the CPU is now critical for Agents to complete work on time.

= Most of agentic task is to get data from to LLM or write data to somewhere. Depending on the task, it can be network or storage bound (reading files, DB, or web). Task is rarely CPU bound. Only task like compilation is CPU bound.

> Continuous Operations: Agents may often run 24/7, necessitating always-on Server CPUs.

= CPU always run 24/7 on server. Nothing new here.