Welcome to Rebound Capital. Here we conduct deep research into beaten-down stocks and study companies that made a successful comeback. Subscribe for free and join 4,300 other investors to make sure you don’t miss our next briefing:

Since our last coverage, ASML has released its Q2 results, providing fresh business insights and an updated industry outlook. Although the company beat analyst expectations, the stock dropped ~6% in a single day and has lost 8% last week.

Let’s unpack.

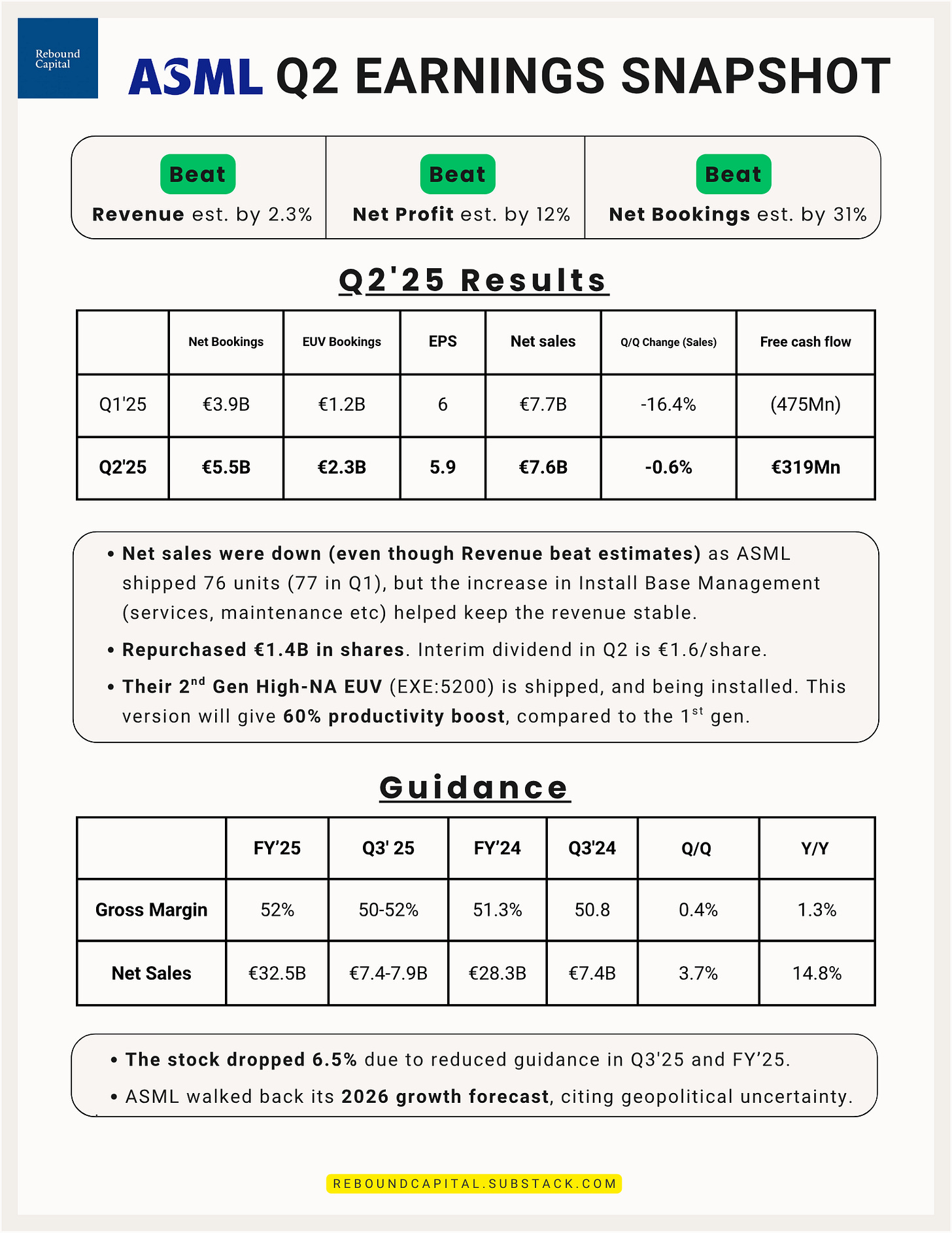

First off, the earnings. ASML’s Q2’25 print was financially sound:

In a nutshell, ASML had beaten the estimates for revenue and EPS. Other metrics like net sales and cash flow were stable, too. Arguably, their most important metric — Net Bookings was also really good, almost double that of Q1.

So what happened?

The guidance. ASML’s management declared that, while they’re very confident in their business and fundamentals, they can’t guarantee growth in 2026 due to geopolitical uncertainties, such as tariffs.

This makes sense. Among the flurry of tariffs being announced since March, a ban was applied on American companies from selling semiconductor chips to China. This was part of a larger effort to limit their access to advanced technology. The ban, however, was effectively reversed in July.

China accounts for ~27% of ASML’s sales. A ban like that has a significant impact on the global semiconductor industry, and companies such as ASML, Nvidia, and TSMC take a hit. More importantly, nobody can predict when a hit like that can come again.

ASML’s uncertainty over the future trumped everything else they had to say, and the stock dropped ~6% in a day. But, ASML’s management also expressed their optimism for the long-term:

Doing a quick back-of-the-envelope valuation

2030 revenue of $60bn (management midpoint), keeping the net profit margin at 30% and share buyback at 1% (current buyback pace).

Assuming no valuation gain (exit PE of 30x), we will get a 2030 target price close to $1,500, which is a 13.5% CAGR, which leaves us with enough margin of safety.

These are pretty good results even on conservative estimates.

Other key insights from the call:

ASML has started shipping and installing its 2nd-Gen High-NA EUV machines, which will give a 60% productivity boost compared to the current generation, and cost €350M a piece.

Their other segment, Install Base Management (service & maintenance), further increased its share in the revenue to €2.1Bn. This is an underrated metric, as it shows the value ASML can derive from a customer beyond the point of sale and is much more consistent than new bookings.

Q2 showed a net profit of €2.2Bn, operating on a 53.7% gross margin. The free cash flow came in around €319M, after repurchasing €1.4Bn in shares.

Going over the earnings and the investor call, it’s clear that the market has severely overreacted. In our deep dive, we mentioned that you should open a small position and gradually increase it depending on the landscape of AI and the U.S.-China relations.

That still stands (and this is a good time to add to the position).

The AI industry is growing rapidly, with power and efficiency at its core. Companies like Nvidia and AMD are designing increasingly advanced chips than ever before.

At the same time, companies like Samsung and TSMC are handling the manufacturing side, meeting the growing demand for AI.

But there’s only one company making the tools to enable that — and they have zero competition.

Quick side note — Since our last report on GLP-1 was long with multiple infographics, some readers had raised a concern that they did not receive it in their inbox. Here is the full report in case you missed it.

GLP 1 Investment Thesis

Welcome to Rebound Capital. Here we conduct deep research into beaten-down stocks and study companies that made a successful comeback. Subscribe for free and join 4,200 other investors to make sure you don’t miss our next briefing:

Investor sentiment has weakened despite fundamentals.