Welcome to Rebound Capital. Here we conduct deep research into beaten-down stocks and study companies that made a successful comeback. Subscribe for free and join 2,500 other investors to make sure you don’t miss our next briefing:

A quick update before we jump in — Nike ($NKE), which we covered two weeks ago in 3 stocks in deep drawdown, jumped 17% yesterday as management highlighted that the largest financial impact from its turnaround plan is now in the past. Google ($GOOG) is also up 7% since we covered it last week.

As many of you requested, here is our complete tracker in one place.

Actionable insights

If you are in a rush, here’s what you should know about ASML Holding:

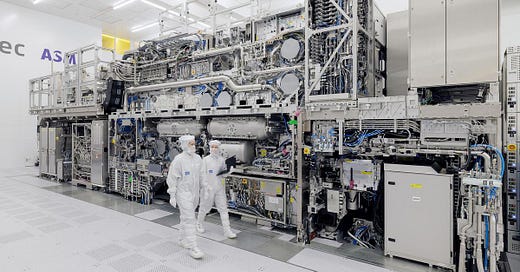

What they do: ASML is the only company capable of manufacturing EUV lithography machines. Each machine sells for around $250 million and is used to create the world’s most powerful semiconductor chips.

Why it crashed: The semiconductor industry was in a cyclical downturn, and the escalating U.S.-China trade war added export restrictions to ASML

Possible catalysts: AI is still going strong, inventory glut seems to be washed out, and ASML is introducing a new product line.

We don't have a monopoly. Anyone who wants to dig a well without a Hughes bit can always use a pick and shovel - Howard Hughes

At the beginning of the 20th century, the ever-increasing demand for oil was pushing companies and industries to find new oil fields and drill faster oil wells. Like everyone who drilled for oil, Howard Hughes Sr. also had trouble creating holes deep in the underground rock formations. The problem was that the existing drill bit at that time wore down too quickly, and the process of replacing it was expensive and time-consuming.

Hughes began experimenting with different modifications to the existing tool bit and struck gold with an improved version in 1908. He patented it and started a company that unsurprisingly became extraordinarily successful - everyone who drilled an oil well wanted the best tool bit to optimize their cost and improve the chances of striking oil (running an oil rig was expensive at ~$250 per hour in the 1900s).

In 1933, two engineers from the Hughes Tool Company invented the Tricone bit, which drilled faster and straighter than any other drill bit in existence, and immediately patented it. The patent ran for the next 17 years, and Hughes's market share approached 100%. Almost all the successful oil discoveries during this era were made using Hughes's tool and helped Howard Junior become the wealthiest man in the world!

AI is the new oil, and ASML has the best drill bit.

ASML is the only company capable of manufacturing EUV lithography machines. Each machine sells for around $250 million and is used to create the world’s most powerful semiconductor chips. These same chips power the GPUs essential to training and deploying modern AI models.

Without ASML’s EUV technology, it would be impossible to manufacture the world’s most powerful silicon chips – the kinds powering the current artificial intelligence boom.

In short, the trajectory of our computational advancement is concentrated in the hands of a provider with a 100% monopoly on a particular kind of magic. — The Generalist (This is a great read to get a deep understanding of what ASML does)

How they make money: 3/4th of ASML’s revenue comes from selling new machines. Since ASML is the only company that supplies these machines, it enjoys premium pricing and has a gross margin of ~50%. The rest of the revenue comes from multi-year maintenance contracts ASML has in place with its buyers.

The deep expertise, AI/Tech boom, and near monopoly meant that the stock has returned more than 3x that of the S&P 500 in the last 10 years.

What went wrong:

The company is now in a deep drawdown and is down 33% over the last year. The main reasons for the drop are:

The semiconductor industry is very cyclical, and we entered a downturn early last year. Following the pandemic boom, the memory chip prices were weak, and there was a glut of inventory. Big customers like Intel and Samsung, slashing cap-ex, also affected ASML.

China accounted for 36% of the sales of ASML in 2024. The U.S. Govt announced stricter chip export controls to China last year — Under these new restrictions, ASML cannot sell any tools to China that contain advanced U.S. Technology.

The slowing industry cycle, added to the government restrictions, meant that new order bookings collapsed in Q3’24 — On this news, the stock plunged 16% in one day, the biggest drop in 26 years since the company went public.

Rebound Catalysts

As we discussed in last week’s report, ASML has some strong catalysts.

The inventory glut is expected to wash out by the end of 2025. In fact, there are early signs with Applied Materials reporting memory inventory levels normalizing in their Q1’25 call.

AI wave is still going strong — The training chips for AI data centers can only be made using EUV scanners that ASML produces. The longer the trend goes on, the better it is for the company.

ASML booked revenue on its first two €350 m High-NA EUV tools in Q4-24. The company is expected to begin volume rollout in 2025-26, creating a brand-new, higher-ASP upgrade wave layered on top of the AI build-out.

The sales export curbs to China are already priced in. Any easing of these restrictions can be a massive catalyst for ASML.

Rebound Potential

While strong catalysts are a good sign, here’s how ASML fares on our quality rubric:

1. Are the fundamental issues with the company cyclical or secular?

Aside from a very few long-shot structural concerns, most of the issues plaguing the company are cyclical.

The semiconductor business is famously cyclical, where when demand booms, customers rush to buy new tools from ASML, and the orders dry up when demand drops. The macroeconomic slowdown over the past two years led to a short-term oversupply of chips, but there is no permanent decline in semiconductor usage.

The primary structural risk here is the potential for U.S.-China decoupling. China accounts for 1/3rd of the sales for ASML (ASML can still sell them mid-range tools), and any rising tensions can permanently limit ASML’s access to the market. In addition to the lost revenue, stringent export restrictions give China further incentives to develop its own lithography machines.

Overall, the challenges appear to be cyclical, and ASML’s wide moat remains strong.

2. Is the unit economics profitable?

Since there are no direct competitors, ASML has incredible pricing power.

Each machine they sell costs $250 million, and they have a ~50% gross margin and ~30% net margin, which is unheard of for a capital equipment manufacturer. It’s also interesting to note that they have been able to maintain these margins through the down cycles.

The other segment is their “installed base management,” where ASML provides service and parts to the equipment they have sold. These contribute to ~30% of ASML’s revenue — and given that an EUV machine can operate for 30 years, these long-term contracts can help ASML ride over the cyclicality of machine sales.

3. How significant is the capital investment risk?

The capital investment risk is significant.

ASML operates in a high-stakes, high-capital-intensive arena. Developing a new model of their EUV machine requires enormous investments and long development cycles. To put this in context, ASML was founded in 1984, and the company shipped its first EUV machine in 2006!

The company has to spend nearly 15% of its revenue on R&D to stay ahead.

Even if the company is successful in creating a new line of EUV machines, it must also consider the risk of customer adoption. As long as Intel or TSMC delay their adoption of the new tech, ASML might not sell as many machines as they hoped.

Finally, the company has significant concentration risk — TSMC, Intel & Samsung account for a majority of their sales (~60%). If any one of them cuts their spending (as Intel did last year), ASML feels it. Being at the mercy of a few customers is a structural risk that we should all be aware of.

4. How strong are the company’s financials?

While the company has grown fast over the last 10 years (from €6 bn to €28bn revenue), 2024 was not a great year for the company. Chip makers (TSMC, Intel, etc) were cautious with their capex and pushed the deliveries of machines from ASML.

Given its monopoly status and premium customer base, the company’s cash flow is exceptionally strong. The company has repurchased more than $3.5 billion worth of stock in 2025 and maintains a strong buyback program.

The balance sheet is equally solid, boasting roughly €9 billion of net cash, minimal leverage, and consistent, growing dividends. In short, even during an industry down-cycle, ASML retains ample liquidity and strong profitability.

5. Is the management clear about the challenges?

The management team has been fairly transparent about the issues:

The company issued muted expectations for 2024 during the Q4’23 earnings release itself. Ex CEO Peter Wennink said that the industry was working through the bottom of the cycle and that 2024 would be a sluggish year (which came out to be on point).

They didn’t hide the bad news and cut their 2025 outlook due to weaker demand in non-AI segments and order delays.

6. Is the current valuation attractive?

At its current price, ASML is trading at a PE of 33, which is slightly lower than the last 5-year average (39). While ASML trades at a premium to the S&P 500 average, we must acknowledge the wide-moat characteristics of ASML.

If ASML hits its high end of guidance (€35 billion), the EPS will grow by 30% — if the stock price stays flat, the P/E can drop into the low 20s.

The funny thing about ASML is that it has no comparable companies to use for a relative valuation. You can argue that Applied Materials or Lam Research qualify, but those companies do not have the tech or the monopoly of ASML.

To put it simply, ASML is not a screaming buy or value play. Summarizing the downsides, ASML has

Large capital investment risk

Customer concentration risk

Rising geopolitical tensions

Industry cyclicality

On the other hand,

The company has great margins, good cash flows, and a strong balance sheet

The widest moat possible for a company

Excellent unit economics and a competent management

My take is that a lot of it will come down to the macro environment. I would start with a small position and gradually add to it based on how AI is trending and how U.S.-China relations are improving. If even one of these is trending in the right direction, ASML has a credible path to “grow into” its valuation by compounding earnings at a high-teens rate over the next several years.

Ultimately, the company is not going anywhere. The only true risk is the tech becoming obsolete, which is not going to happen overnight. Gradual accumulation will allow us to capture the upside without betting the farm on timing the cycle.

If you found this interesting, please share this report with a friend.

We would love to hear what you think.

Rebound Capital’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research

I usually focus on the quant side of trading, so it was refreshing to come across this piece on ASML. Really enjoyed the shift in perspective and it sounds like the company has an interesting story!

The Howard Hughes analogy is spot on, ASML really does feel like the drill bit of the AI era.

Your content is gold, keep it coming!