Welcome to Rebound Capital. Here we conduct deep research into beaten-down stocks and study companies that made a successful comeback. Subscribe for free and join 1,900 other investors to make sure you don’t miss our next briefing.:

JP Morgan recently released a report highlighting the effectiveness of using consumer sentiment for investing - On average the S&P 500 returned only 4% in the next 12 months if you invested when the consumer sentiment was at its peak whereas if you invested when the consumer sentiment was at its lowest, over the next 12 months, your average return was 24.9%!

A 6x increase in returns just by investing when everyone else was skeptical to do so.

The same concept applies to individual companies. Every company goes through periods of confidence crisis where investors write them off. While not all drawdowns are equal, here are three companies within our investable universe that are in a deep drawdown.

As always, there are potential bargains that warrant a closer look, not blind investment. Read till the end to vote on which company you want us to do a deep dive on!

1. ASML Holding ($ASML)

As The Generalist puts it, ASML has a monopoly on magic. It’s the only company that can make EUV lithography machines. Each machine sells in the range of $250M and is used to create the world’s most powerful semiconductor chips.

Drawdown

The company is now in a deep drawdown and is down 33% over the last year. The main reasons for the drop are:

The semiconductor industry is very cyclical, and we entered a downturn early last year. Following the pandemic boom, the memory chip prices were weak, and there was a glut of inventory. Big customers like Intel and Samsung slashing cap-ex also affected ASML.

China accounted for 36% of the sales of ASML in 2024. The U.S. Govt announced stricter chip export controls to China last year — Under these new restrictions, ASML cannot sell any tools to China that contain advanced U.S. Technology.

The slowing industry cycle, added to the government restrictions, meant that new order bookings collapsed in Q3’24 — On this news, the stock plunged 16% in one day, the biggest drop in 26 years since the company went public.

Rebound Catalysts?

The inventory glut is expected to wash out by the end of 2025. In fact, there are early signs with Applied Materials reporting memory inventory levels normalizing in their Q1’25 call.

AI wave is still going strong — The training chips for AI data centers can only be made using EUV scanners that ASML produces. The longer the trend goes on, the better it is for the company.

ASML booked revenue on its first two €350 m High-NA EUV tools in Q4-24. The company is expected to begin volume rollout in 2025-26, creating a brand-new, higher-ASP upgrade wave layered on top of the AI build-out.

The sales export curbs to China are already priced in. Any easing of these restrictions can be a massive catalyst for ASML.

2. Merck & Co ($MRK)

Merck & Co. is a leading pharmaceutical company that develops and sells prescription medicines, vaccines, biologic therapies, and animal health products. Human health contributes 90%, and the Animal Health division contributes the other 10% in revenue.

Drawdown

The stock price has been in a structural decline ever since March 2024. It’s down 20% YTD and 40% from its ATH.

One of Merck’s key products, Gardasil (an HPV Vaccine), had a sharp slide in demand after they halted shipments to China. Increasing local competition in China and a drop in discretionary health spending after Covid were the key reasons for the dropping demand.

50% of Merck’s revenue comes from one drug — Keytruda. The patent for this cancer drug is expected to run out by 2028. Once it does, a rush of low-cost competitors will enter the space.

The company also scrapped two Phase 3 trials of therapies improving upon Keytruda.

Rebound Catalysts?

Two new products, Capvaxive and Winrevair, are expected to add meaningful sales starting this year. However, analyst estimates suggest that these combined will only provide $3-$5 billion in incremental revenue by 2030. (compared to Keytruda, which brings in ~$30 billion per year)

The company has many late-stage pipelines that offer multiple shots on goal. Positive Phase 3 read-outs on any of these assets would boost Merck’s valuation.

On a related note, it’s fascinating to look at the P/E ratio of Merck. It’s currently at 11.5 while the S&P 500 is at 28! In our last deep dive on The Trade Desk, one reader had commented about the high P/E ratio (TTD is now trading at a P/E of 83).

While a high P/E is concerning, it shouldn’t be the only factor that we should consider. If given the choice, I would prefer TTD over Merck, even if the former is trading at 8 times the PE.

3. Google ($GOOG)

While I wouldn’t call this a deep drawdown, Google is going through a tough time. The company is down 18% from its all-time high, and just a month ago, it was down 30% from its peak.

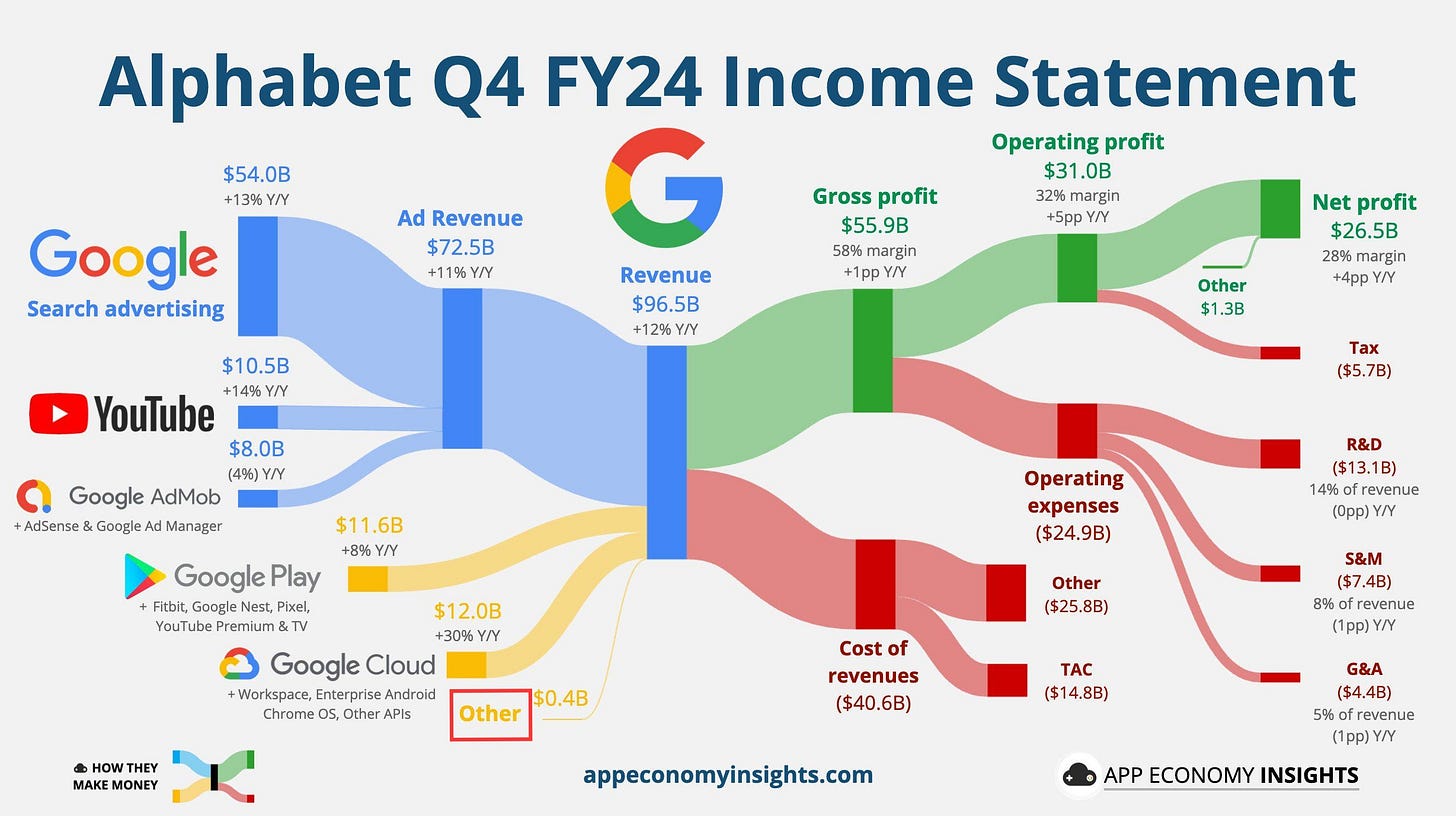

The issue started with the Q4’24 earnings miss — The company posted slightly lower revenue and revealed a dramatic increase in capital expenditure for AI. Google is aiming to invest $75 billion in AI & Infra this year, which was far above Wall Street’s expectations.

The main issue now is whether Google will be able to maintain its search dominance. ChatGPT has already surpassed Bing Search in traffic, and Similarweb is predicting that ChatGPT can overtake Google in the next two years.

Even big players are looking at alternatives — Apple executives are considering buying Perplexity to replace Google as its default search engine.

Finally, while all this is going on, Google is facing antitrust lawsuits that claim that Google has an illegal monopoly over online search and advertising.

Rebound Catalysts?

Before we get into this, the main problem with Google is its scale. The company is already worth $2 trillion. For example, even though Google Waymo is doing really well, the entire revenue from that division will come under the other section highlighted below. So while evaluating catalysts, we should be careful to consider those that will actually move the needle!

Google is aggressively pushing AI summaries in the traditional search results. Google claims that AI overviews can generate the same ad revenue as conventional search results.

A resolution on the antitrust lawsuits that is less damaging than expected can be a catalyst. Google might also be able to adapt to regulatory changes without materially hurting its revenue.

There is significant room for multiple expansion — Google is now trading at a PE of 18 compared to 30 for Microsoft. If Google can demonstrate that growth will reaccelerate and it can weather the threats, just multiple expansion alone should generate excellent returns.

Wild Cards: Visa & Mastercard

In case you missed it, both Visa and Mastercard are down more than 5% this week after the Stablecoin bill passed the Senate.

As always, before making your decision, be sure to evaluate each company based on our quality rubric.

Are the fundamental issues with the company cyclical or secular?

Is the unit economics profitable?

How significant is the capital investment risk?

How strong are the company’s financials?

Is the management clear about the challenges?

Here’s how we did that for The Trade Desk:

We would love to hear what you think.

Visa and Mastercard , I heard on the real Steve Eismann playbook how good of a business these both are. Would be keen to get another persons insight as well.

Either ASML or Visa / MC. For the former, some have been saying the US should create an ASML; how effective is their moat? For V/MA, should we be viewing stable coins as threats or opportunities? Thanks!