Welcome to Rebound Capital. Here we conduct deep research into beaten-down stocks and study companies that made a successful comeback. Subscribe for free and join 1,700 other investors to make sure you don’t miss our next briefing:

From our last week's report on three potential bargains that warrant a closer look, 47% of you voted for a deep dive on The Trade Desk ($TTD). So, get a cup of coffee and settle in — This one’s a story of explosive growth, a dramatic fall, and a possible comeback!

Actionable insights

If you are in a rush, here’s what you should know about The Trade Desk:

What they do: The Trade Desk operates one of the world’s largest independent programmatic advertising platforms. It helps brands and agencies bid in real-time across TV, display, audio, mobile, and retail-media inventory.

Why it crashed: Missed revenue guidance in Q4’24. Slow and buggy rollout of their new AI platform and some headwind on the macro side.

Possible catalysts: Strong Q1’25 results, improved guidance, and successful integration of the AI optimization layer.

The Trade Desk (TTD) is a company that provides a platform for ad buyers. In simple terms, TTD provides advertisers, such as Marriott and Vanguard, with a self-service platform to purchase ads across various formats, including banner ads, online video, in-app ads, and more.

It fundamentally differs from other players like Google and Meta ads — Instead of a walled garden approach1, they buy eyeballs from established players like National Geographic, Spotify, Walmart, etc., and offer advertisers a platform to bid on these. This is an important distinction as TTD does not favor any publisher over others. In contrast, if you go to Amazon DSP or Google’s Ad service, they steer the ad spend towards their platform (YouTube, Prime Video, etc.)

How they make money: Simple — They charge a percentage of the advertising spend the clients spend on their platform (currently ~20%). The company enjoys software-like margins because it doesn’t buy ad inventory upfront and carries no inventory risk. The more their customers spend on their platform, the more TTD will earn.

Even though the company charges a steep platform fee, advertisers don’t seem to mind due to the breadth of inventory, neutral approach, and access to sophisticated targeting provided by TTD. The company has consistently maintained customer retention of over 95% for the past 11 years2!

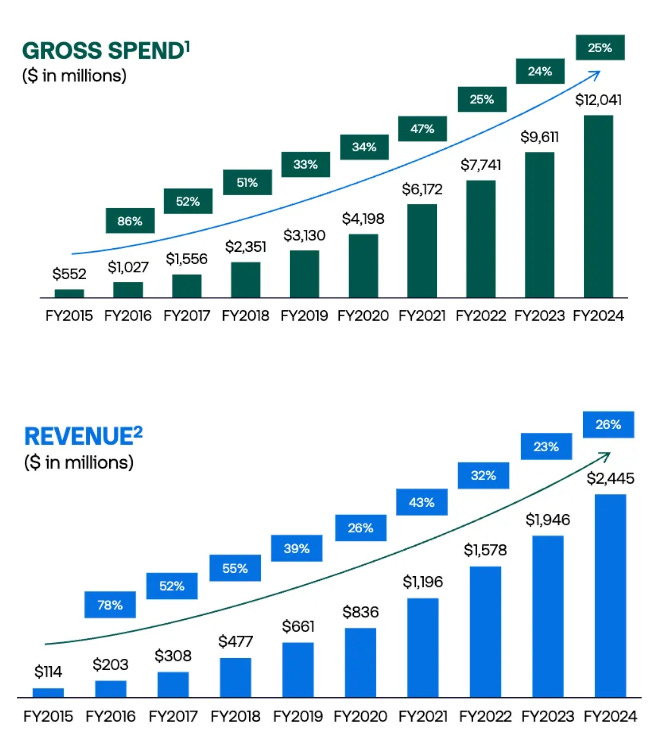

The exceptional growth and customer retention have been reflected in TTD stock returns. Since their IPO in 2016, the company has returned a whopping 2,233% compared to the 178% return of the S&P 500.

What went wrong:

The company is down 51% from its previous ATH in Dec’24 and is down 42% for the year. The company has recovered some of its losses and is up 50% from its bottom in Apr’25.

The drawdown was due to a mix of macroeconomic and structural reasons.

For the first time since going public in 2016, the company missed its revenue guidance for the quarter. Q4’24 revenue came in at $741 million, which was $15 million short of the $756 million target set by the management. Up to that point, the company had a 33-quarter streak of meeting or exceeding guidance. The stock plunged nearly 30% on the day of the earnings call.

The revenue shortfall was due to the slow and buggy rollout of the company’s next-generation ad-tech platform, Kokai. Since this was at the core of the company’s new update, it might have caused some friction for their clients, affecting Q4 spend.

In addition to this miss, the management also issued cautious guidance for 2025 — projecting only a 20% growth, which was weaker than what analysts had hoped for (high 20s).

Finally, the macroeconomic uncertainties meant that ad spend was muted. Even Google’s advertising and Amazon’s ad business showed slow growth in late 2024.

Rebound Catalysts

As we discussed in last week’s report, The Trade Desk has some strong catalysts

Last month, the company reported a 25% YoY growth in revenue and margins expansion to 8%. The forward guidance projects continued growth for Q2’25.

Two-thirds of The Trade Desk’s clients are already transacting on Kokai, the company’s new AI-powered optimization layer.

Acquired Sincera, a digital advertising data company, at the end of the first quarter.

The balance sheet is very strong with $1.7 billion in cash & short-term investments with zero debt.

Rebound Potential

While strong catalysts are a good sign, here’s how The Trade Desk fares on our quality rubric:

1. Are the fundamental issues with the company cyclical or secular?

Most of the issues the company is facing are cyclical. Although the advertising market experienced a slight lag in 2024, demand remained strong. Even TTD’s management stated that the Q4 miss was due to internal execution issues, and the 25% growth last quarter supports this theory.

This is a good sign — it shows that demand was always there, and TTD just failed to capture it due to execution missteps.

An existential concern for the company is the rise of walled gardens and closed ecosystems (Facebook, Amazon, Google, etc.), which are capturing ad spend. The open internet has to compete with these platforms on both performance and volume. If advertisers allocate more budget to these companies, it’s a secular headwind for TTD.

As of today, the evidence suggests we are in a good balance. Advertisers cannot fulfill all their goals on walled gardens alone, and the open internet spend remains strong.

Another concern is that larger players, such as Google and Amazon, are increasingly moving into Connected TV advertising, which is the bread and butter of TTD. However, as we noted earlier, these companies have competing priorities and will always struggle to build an unbiased platform like TTD.

2. Is the unit economics profitable?

One of TTD’s strongest fundamental attributes is its highly attractive unit economics. Since the company takes a cut of each advertising dollar flowing through its platform, it has very high gross margins. Since there are no additional direct costs involved other than the infrastructure, TTD enjoys software-like margins at 75 to 80%.

Additionally, this allows them to grow rapidly without proportionate investment in R&D and sales and marketing costs.

Our business model has allowed us to grow significantly, and we believe our operating leverage enables us to support future growth profitably. — TTD 10K

This sort of margin and pricing power helps provide a cushion in downturns. For example, TTD remained profitable through the Covid pullback in early 2020.

3. How significant is the capital investment risk?

TTD is an asset-light company — the total CapEx for 2024 was only $98M, which is less than 4% of their $2.5B revenue. The company invests heavily in R&D, with ~$500M spent in 2024. However, this is for long-term platform improvements and not an existential risk, even if one or two products fail, given their very strong balance sheet ($1.4 billion in cash and $500 million in short-term investments).

The company is in a phase where it can self-fund all its growth initiatives and still generate very strong cash flows.

4. How strong are the company’s financials?

We have touched upon some of the financial aspects, but let’s consolidate why TTD has a really strong position:

Strong growth — Despite the revenue miss in Q4’24, the company was still up 26% YoY. As we just saw, the faster the company can grow, the more free cash flow it can generate, given its high margins and low capital expenditures.

Excellent Profitability & Cash Flow — While the company grew 25% in 2024, what was impressive was that TTD’s net income margin expanded from 9% to 16%, showcasing the improving operating leverage we discussed previously.

Stock Buybacks — The board has authorized a $564 million share buyback in Feb’25.

Strong gross margins — The company has maintained gross margins above 80%, justifying its software-like valuation.

5. Is the management clear about the challenges?

This, for me, is the best bit — They have been transparent and accountable throughout this crisis!

CFO Laura Schenkein explicitly said that “it was on us” about the Q4 earnings miss, and CEO Jeff Green said that it was a stumble due to execution errors. They might as well have attributed the miss to the macroeconomic conditions. From an investor's standpoint, I would take this honesty any day over sugarcoating. It also suggests that the company is more likely to address the root cause of the issues instead of ignoring them.

They started the change even before the earnings report. In December 2024, TTD implemented an organizational restructuring to establish dedicated teams for industry verticals. They are also planning to double the number of senior leaders to avoid future execution issues.

TTD is a growth stock and is priced for perfection. The company traded at a sky-high P/E ratio of 117 at the end of last year before coming down to the current P/E of 67. It’s still high, and there is very little leeway when you have such valuations. This explains the massive swings in the stock price.

TTD has experienced multiple 30%+ drawdowns in the past 5 years, and the company has rebounded stronger each time.

During the 2020 pandemic, the company had a 46% drawdown due to a broad market sell-off and advertisers cutting budgets. TTD responded by expanding globally, thereby capturing future demand.

In early 2021, a significant update from Google regarding its ad-tracking policy caused TTD stock to drop 20% in two days. In response, the TTD management developed an alternative identity solution to track customers.

Once again, in late 2021/early 2022, the ad tech downturn amid rising inflation and interest rates caused the stock to drop 60%. The company responded by announcing a $700M buyback and doubling down on growth areas. TTD reported a 32% revenue growth in 2022!

Given the management track record, the current drawdown might be just another speed bump in the long run!

If you found this insightful, please share this report with a friend.

We would love to hear what you think. Reply to this email or

Footnotes

You can buy only Instagram and Facebook ads from the Meta Ads platform.

Source: SEC Filing

Disclaimer — This publication’s authors are not licensed investment professionals. Nothing produced under the Rebound Capital brand should be construed as investment advice. Do your own research before investing.

Really good read and analysis broken down really well. I actually voted for you to cover TTD and glad I did really good stock. Going to hit the SEC fillings on the weekend and then look to take a position.

Balance sheet looks fantastic, and the revenue growths right there waiting to be tapped into. A great find.

Great write up. TTD appears overvalued based on PE and forward PE ratios, but I’m wondering if you think earnings don’t tell the complete story. As you pointed out, OCF outweighs earnings. To what degree do you analyze cash flows versus earnings in your investments?