Welcome to Rebound Capital. Here we conduct deep research into beaten-down stocks and study companies that made a successful comeback. Subscribe for free and join 2,200 other investors to make sure you don’t miss our next briefing:

An often underrated strategy is buying individual companies during periods of market distress. While buying the dip is almost a reflex for us, we often shy away from buying the underlying companies that are in distress. However, doing this meticulously can yield exceptional returns.

Case in point — Covid-19 crash. While the S&P 500 dropped 30% in 2 months following the lockdown, United Airlines lost 76% of its value. Even though the stock is now barely above its pre-pandemic value, if you had invested after the Covid crash, you would have 2x the return of investing in the S&P 500.

On that note, today we look at one company that almost went bankrupt during the Covid lockdowns. At its lowest, this 140-year-old company was down 88% from its ATH. Just 3 years later, it’s up ~1,600% from its lows.

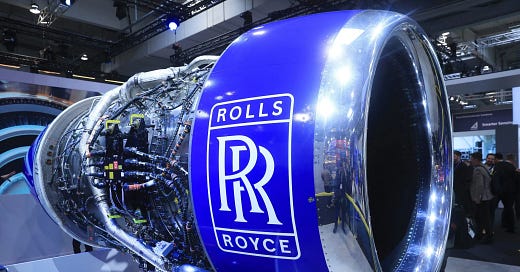

Here’s the Rolls-Royce Turnaround Story:

While the Rolls-Royce name is synonymous with luxury cars, Rolls-Royce has long sold its branding to BMW. The company we are analyzing today has no stake in the car company.

What Rolls-Royce Holdings plc (OTC: $RYCEY) actually makes is arguably more sophisticated engineering products.

Civil Aerospace (~50% of revenue)

Jet engines for Airbus, Boeing, & private jets

Helicopter engines

Defense (~25% of revenue)

Combat aircraft engines

Nuclear reactors for submarines (Also recently for public energy)

Power systems (~24% of revenue)

High-speed diesel engines

Battery Energy Storage Systems

The beauty of their business model is that for every engine that they sell, they also sell a Long Term Service Agreement (LTSA). This is a subscription-style engine service contract where airlines pay Rolls-Royce a fixed fee for servicing the engine for every flying hour.

So, the more an airline flies, the more money Rolls-Royce makes. It’s estimated that ~70% of the civil-aerospace revenue comes from these long-term agreements.

What went wrong:

With this business model, you might already have an idea where it went wrong. While the company had a relatively muted few years leading up to 2020, the pandemic decimated their business.

The global air travel industry came to a standstill in 2020, and as Rolls-Royce's business heavily relied on airline flying hours, it experienced a massive drop in revenue. By October 2020, the company had lost 80% of its value from the start of the year and reported a record £5.4 bn first-half loss.

The company was now trading at penny stock levels and, to survive, had to conduct a £2 billion rights issue and lay off 9,000 employees, which again pushed the stock price down.

The only bright spot during the pandemic was that the company won the contract to supply engines for the U.S. B-52 replacement program (the same ones that just bombed Iran). But just as the CEO announced that he would step down by the end of the year in February 2022, Russia invaded Ukraine. This meant that Rolls-Royce was forced to cut ties with Russian Titanium suppliers, which is a critical ingredient for jet engines.

The Rebound:

For those who were tracking closely, there were clear signs that the worst was over by mid-2022.

Warren East, CEO, had noted that the cash flow had improved by £1 billion YoY compared to 2021.

Engine flying hours had crept up to 60% of 2019 levels (Critical for RR’s LTSA)

The company’s order intake was rising with new orders from Malaysia Airlines, Norse Atlantic, and Qantas.

Finally, the volatile geopolitical climate meant that defense budgets were rapidly climbing across Europe and the U.S.

Q1’23 — New CEO who immediately acknowledged the issue and called the company a “burning platform” in need of radical change. For us, the management acknowledging the real issue is half the job done. The full year results released for 2022 were also positive — operating profits rose by 57% and net debt was down by £2 bn in 2 years due to improved cash flow. Also, China (one of the biggest airline markets) opened up its international air travel.

Q3’23 — Half-year results showed significant improvement in operating profit as well as margin expansion to 9.7% (versus only 2% prior). The company also secured a substantial long-term service agreement with the U.S. Department of Defense.

Q4’23/Q1’24 — The CEO revealed that the company was on track to meet its operating profit goals a full two years early and increased its guidance. The full 2023 results released in Q1’24 showed robust results with a £1.6 bn operating profit (vs. £652 mn for 2022). By the summer of 2024, the global air traffic had fully recovered to pre-pandemic levels on most routes.

Just as in the case of Meta, even though the rebound was relatively quick, savvy investors had multiple good entry points.

Here’s the crazy part — The above chart ends in June 2024, where the stock was up 600% from its bottom. Over the last year, the stock has increased by another 114% with the company announcing a dividend and a £1 bn share buyback program.

This is exactly why we started Rebound Capital. All great companies stumble once in a while and offer you plenty of opportunity to buy them for cheap. The only thing you have to do then is hold. If you enjoyed this report, please share this with a friend.

We would love to hear what you think.

With the company's strong financial performance and growth prospects, it's exciting to see how they continue to innovate and lead in the aerospace and defense sectors. Looking forward to seeing how the UltraFan engine development progresses.

Learning a lot from these articles, thank you for your efforts. Any tips on how to spot these companies early on (in drawdown)?