Welcome to Rebound Capital. Here we conduct deep research into beaten-down stocks and study companies that made a successful comeback. Subscribe for free and join 3,300 other investors to make sure you don’t miss our next briefing:

A quick update before we jump in — Our deep dive on ASML is now our most popular report yet. Also, five out of the eight stocks that we covered in our previous deep drawdown reports have now outperformed the market (while it’s good, the short-term outperformance was never our aim). Here is our complete tracker in one place.

As always, the following are potential bargains that warrant a closer look, not blind investment. Read till the end to vote on which company you want us to do a deep dive on!

1. Advanced Micro Devices ($AMD)

AMD designs high-performance processors and graphics cards for servers and PCs. Half of their revenue comes from data-center products and the other half from PC chips, gaming products, and embedded devices.

Drawdown

AMD is in a deep drawdown, having lost more than half its value from April 2024 to April 2025. This is in contrast to its competitor, NVDA, which has risen 26% over the last year. So, what happened?

In the Q2’24 earnings report, AMD’s gaming hardware revenue dropped by 59% due to a fall in demand for semi-custom chips used in PlayStation & Xbox.

Even though the revenue from AMD’s AI processors jumped 69% in Q4’24, it still missed the lofty expectations set by the analysts.

While the company continues to take market share from Intel in CPUs, it still lags behind Nvidia when it comes to GPUs (which are critical for powering AI/LLMs)

Rebound Catalysts?

From its bottom in April, the company is now up 57% in the last 3 months.

AMD delivered a strong first-quarter earnings that beat expectations — revenue is up 36% YoY, and data center sales rose 57%. This suggests that AMD’s AI chips may finally be gaining traction.

The company launched its new Instinct MI350 series, which claims to have 60% more memory than Nvidia chips, and can create 40% more generated tokens for every dollar spent. If these numbers hold up in the real world, it could force AI data centers to diversify away from Nvidia sooner than expected.

AMD announced a $6 billion buyback program and a string of quick acquisitions focused on AI (Brium & Untether)

2. Bumble ($BMBL)

This one’s a bit different, and it's a high-risk, high-reward turnaround play. Bumble is a small-cap stock with a market capitalization of only $670 million. Unlike other stocks we cover, you now have to factor in bankruptcy risk as well.

The company operates a women-first dating app, generating most of its revenue through paid subscriptions.

Drawdown

Bumble has been in a deep structural drawdown ever since it IPO’ed in 2021. The company has lost more than 90% of its value in the last 4 years.

Dating-app adoption peaked during Covid lockdowns and all companies in the sector are facing user fatigue. The dropping engagement meant that the average revenue per user has also been in a free fall.

The company has never been sustainably profitable — It was only profitable in its IPO year, and then it has lost money in all the others.

Bumble’s Women-First approach now faces market saturation, as we can see from their sluggish growth rate. Plus, the company is facing intense competition on the user acquisition front from the Match Group and Hinge.

Rebound Catalysts?

While the chances are slim, the company might be on the verge of a turnaround, as we highlighted on X (follow us there to get daily updates)

The founder returned as CEO last quarter and is now heavily investing in new features. The only way for a sustained turnaround is to come up with innovative features to engage the Gen-Z crowd and improve their ARPU.

The company recently laid off 30% of its employees, with estimated cost savings of $40 million (might be enough to push the company into profitability)

Finally, for what it’s worth, the company has improved its revenue guidance and has raised its outlook for adjusted earnings. The stock price already discounts for significant execution risk (single-digit EV/revenue multiple) — so any successful product improvement/profitability can trigger a rebound.

3. Pepsi ($PEP)

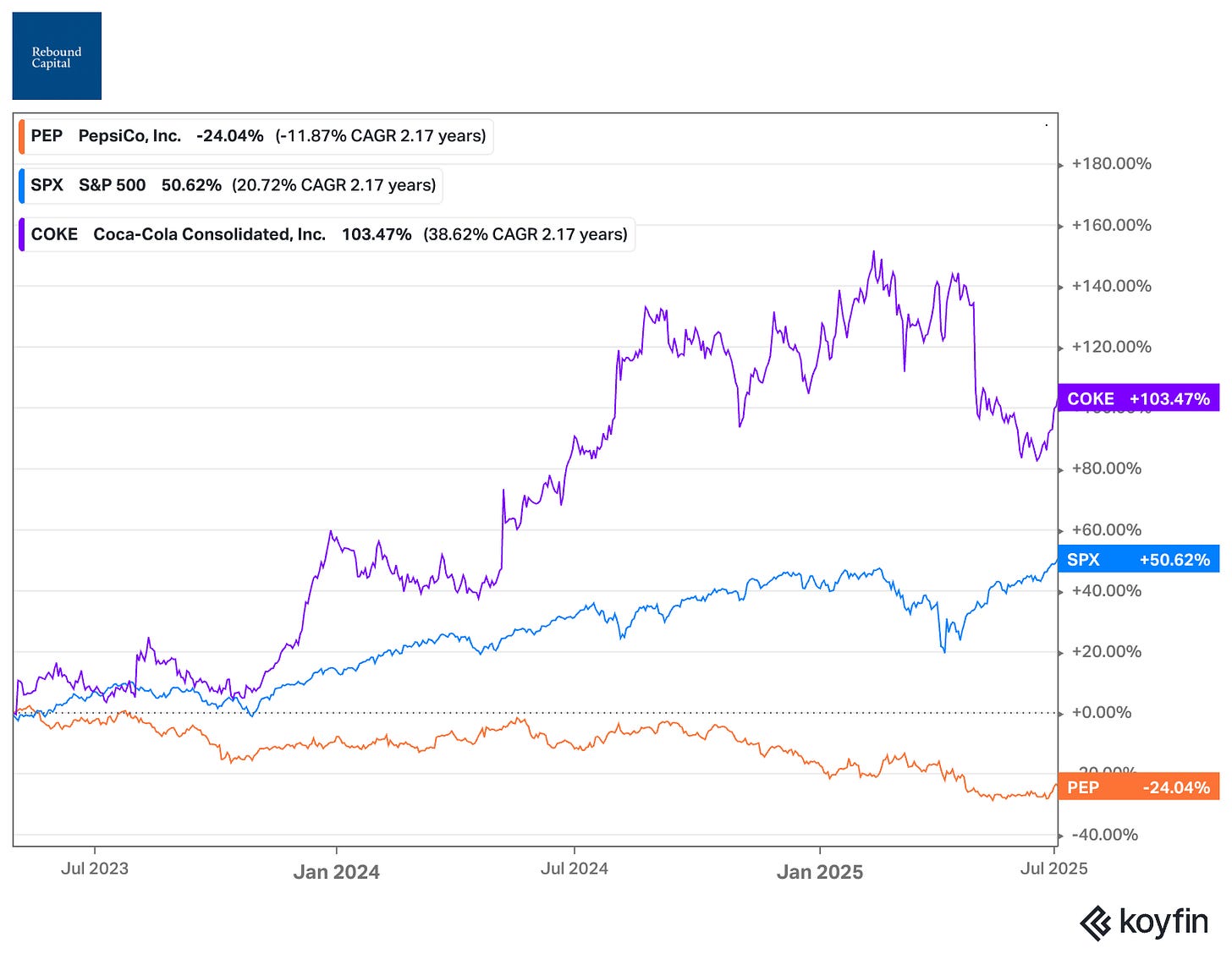

This one was a bit surprising — In the last 2 years, while Coca-Cola has gone up by 103%, Pepsi is down 24%. Even more surprisingly, Pepsi earns more from its snack division than from its beverages!

Pepsi had significantly raised its product prices after its strong results running up to 2023. The persistently high inflation in 2023 meant that consumers cut down on snacks or chose cheaper alternatives to Pepsi. As a result, the company missed its sales forecasts and had to reduce its organic growth projection.

Adding to the already weaker demand, the company had to recall Quaker Oats due to a potential Salmonella outbreak.

Finally, the 25% tariff on imported aluminum and the 10% tariff on its concentrate forced the company to give flat guidance for 2025 projections.

Rebound Catalysts?

In May 2025, the company acquired prebiotic soda brand Poppi for $1.95 billion. Pepsi is also reporting that Pepsi Zero, Propel functional water, and Gatorade Zero (all high-margin products) are posting double-digit revenue growth and gaining market share.

The Quaker recall has been fully closed by the FDA, and management has said that Quaker drove strong organic revenue growth in Q1’25.

Easing inflationary pressures and improving consumer confidence could boost spending on discretionary items (especially on snacks). The management is also playing around with smaller packaging to boost volume.

More interesting ideas

We cover a lot more ideas on our Twitter that’s just not possible here. So, do check us out there.

Trump just announced a trade deal with Vietnam. Here are six companies that could rebound due to this deal.

Tesla is down 27% its ATH — But it might just be a falling knife.

Healthcare stocks are still taking a beating due to medicare cuts.

We would love to hear what you think.