Welcome to Rebound Capital. Here we conduct deep research into beaten-down stocks and study companies that made a successful comeback. Subscribe for free and join 4,000 other investors to make sure you don’t miss our next briefing:

A quick update before we jump in — We crossed 4,000 subscribers in just 40 days. Thank you so much for all the support. All we ask is that you please “like” the articles you enjoyed reading.

Coming over to performance, AMD which we covered in our last week’s drawdown report is now up 8%, and our drawdown watchlist continues to perform strongly.

As always, the following are potential bargains that warrant a closer look, not blind investment. Read till the end to vote on which company you want us to do a deep dive on!

1. Fair Isacc Corp ($FICO)

Fair Isaac Corp., known for the FICO credit score, provides the scoring algorithms used widely in consumer lending. It also sells analytics and decision-management software to banks and enterprises, making it a key player in credit risk assessment and fraud detection.

Drawdown

The company is in a deep drawdown having lost 35% of its market cap in the last 6 months. This is highly unusual as FICO is a high quality stock with an extremely strong moat.

To put the current drawdown in perspective, after the Global Financial Crisis in 2008, the next time the stock had more than a 30% drawdown was during the Covid crisis in 2020!

So, what went wrong now?

The whole issue started at the end of 2024 when FICO raised its price from $3.50 to $4.95 per score for mortgage originations.

The biggest catalyst was when U.S. FHFA announced that government-backed lenders (Fannie Mae and Freddie Mac) can now use the VantageScore 4.0 model instead of FICO for evaluating borrowers.

Beyond this, due to their strong brand, FICO always trade at a lofty valuation. At the beginning of this year, FICO was trading at a P/E of 95 which meant that the stock is very vulnerable to any bad news.

Rebound Catalysts?

While not per se a catalyst, I think the price rise is blown out of proportion.

“With average closing costs of approximately $6,000 per mortgage, FICO’s royalties remain an exceedingly small percentage — approximately two tenths of 1 percent (or less) — of a consumer’s closing costs and are therefore not an impediment to home ownership,” FICO CEO Will Lansing

Secondly, the VantageScore rule is optional, and lenders may not rush to switch given FICO’s ingrained usage and the minimal cost savings involved.

Finally, FICO’s dominance and decades-long relationships might mean that lenders might not be willing to risk their money for an additional $1.45 per application.

2. Eli Lilly and Company ($LLY)

Eli Lilly is a global pharmaceutical company known for its innovative drugs in diabetes, obesity, oncology, and neurology. The success of Lilly's diabetes and weight-loss treatments has propelled the company to become the 12th-largest publicly listed firm in the U.S.

Drawdown

While I wouldn’t call it a deep drawdown, the stock is down 15% over the last year.

CVS dropped Eli Lilly’s obesity drug Zepbound from the list of medicines it covers for reimbursement. Losing this status meant less automatic reimbursement and fiercer price competition with Novo Nordic’s weight loss drug.

Lilly started selling the two highest Zepbound doses online for $499/month, well below list price, to win self-pay patients and blunt compound-pharmacy copies. This could cause a drop in the average selling prices for the drug.

Rebound Catalysts?

Demand for its GLP-1 drugs (weight loss drug) is still enormous, and the only real issue is making enough of the drug. Lilly’s management is pouring billions into new plants to lift GLP-1 capacity.

Lilly’s broader pipeline is rich: it recently launched new medicines for ulcerative colitis (Omvoh), lymphoma (Jaypirca), and Alzheimer’s (donanemab, brand name Kisunla), which should bolster sales beyond just diabetes/obesity.

3. The Estée Lauder Companies ($EL)

Estée Lauder is a leading prestige beauty conglomerate with brands spanning cosmetics, skincare, and fragrances. The company derives a large portion of its sales from global travel retail (duty-free shops) and the Chinese consumer market.

Fun side note — This stock came into my watchlist after Michael Burry sold all his other positions and went all in on this company. Estée Lauder is his only stock position. Talk about conviction.

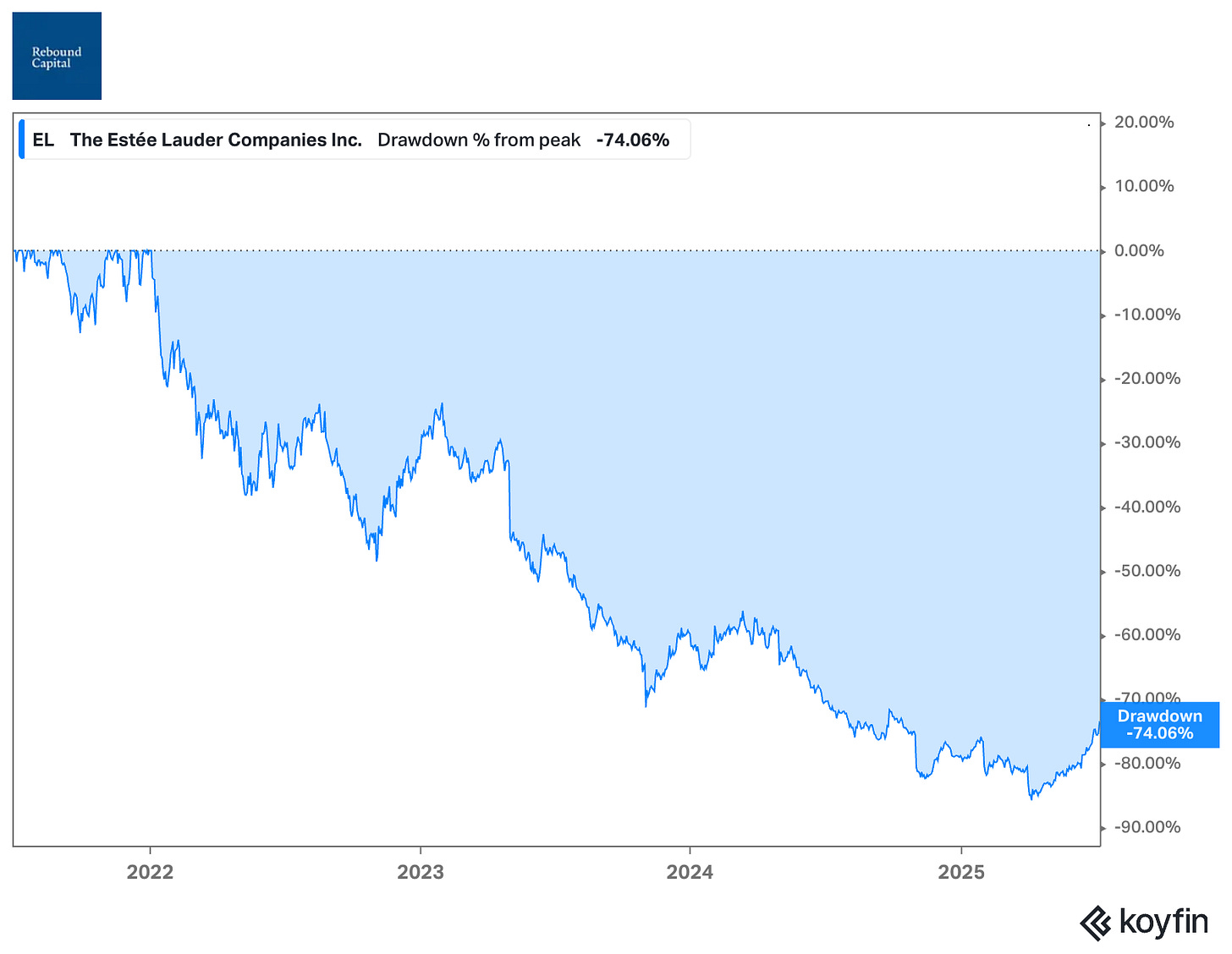

Drawdown

The company has been in a structural drawdown and has dropped close to 80% from its all-time highs in early 2022. This three-year slump stems from a perfect storm of adverse factors, primarily centered on a faltering Asia market.

During the pandemic, Chinese tourism and travel retail – a critical sales driver for Estée – came to a halt. More damagingly, even after COVID restrictions lifted, Chinese consumer spending did not rebound as expected.

Due to this, operating income crashed from $3.2 billion FY-22 to $0.97 billion FY-24 (-70 %) and operating margin slid from 17 % to 5 %.

The company paid $2.8 billion for Tom Ford brand in 2023 and had to do a $773 m impairment on the Tom Ford trademark just two years late due to lower than expected growth.

Rebound Catalysts?

The new CEO of the company, Stéphane de La Faverie unveiled a plan called Beauty Reimagined to restore sustainable sales growth. The company is up 40% from the date of announcement.

The company has also started an internal restructuring with a 5,000 to 7,000 job cuts to save costs.

Even though the sales are declining, the restructuring seems to working with the company beating analyst expectations for its latest quarter.

We would love to hear what you think.

Estee is a well-recognised brand in Asia and likely to rebound once, or rather, if, the tariffs uncertainty is cleared. Asian consumers especially, tend to defer discretionary purchases, even if they can afford Estee's products.

I'm UK based, from a consumer perspective I worry that everyone doesn't have much "spare money" so Estée Lauder maybe tricky, however, I am hearing more and more about weight loss medication and with our NHS now prescribing it LLY could be a good option. I've also worked at banks and know how slow things are to change, so a small increase in costs per application is really not a big deal (in my honest opinion) so could be an over reaction... But what do I know I am just a Janner.