Welcome to Rebound Capital. Here we conduct deep research into beaten-down stocks and study companies that made a successful comeback. Subscribe for free and join 3,900 other investors to make sure you don’t miss our next briefing:

A quick update before we jump in — Our drawdown watchlist continues to perform strongly (+6.4% vs. 3.1% S&P 500). 7 out of the 11 stocks have outperformed the market, and only one has lost money so far ($UNH). The Trade Desk, which was a buy based on our deep dive, has returned 2.5x that of the market!

As always, here is our complete tracker in one place.

Actionable insights

If you are in a rush, here’s what you should know about Advanced Micro Devices:

What they do: AMD designs high-performance processors and graphics cards for servers and PCs.

Why it crashed: Drop in gaming hardware revenue, inflated analyst expectations on AI processors, and strong competition from Nvidia.

Possible catalysts: Industry cyclicality seems to be on the upswing, new AI chips claims to outperform that of Nvidia, and strong buyback program.

AMD designs high-performance processors and graphics cards for servers and PCs. They primarily focuses on designing chips and outsources its fabrication to companies like TSMC.

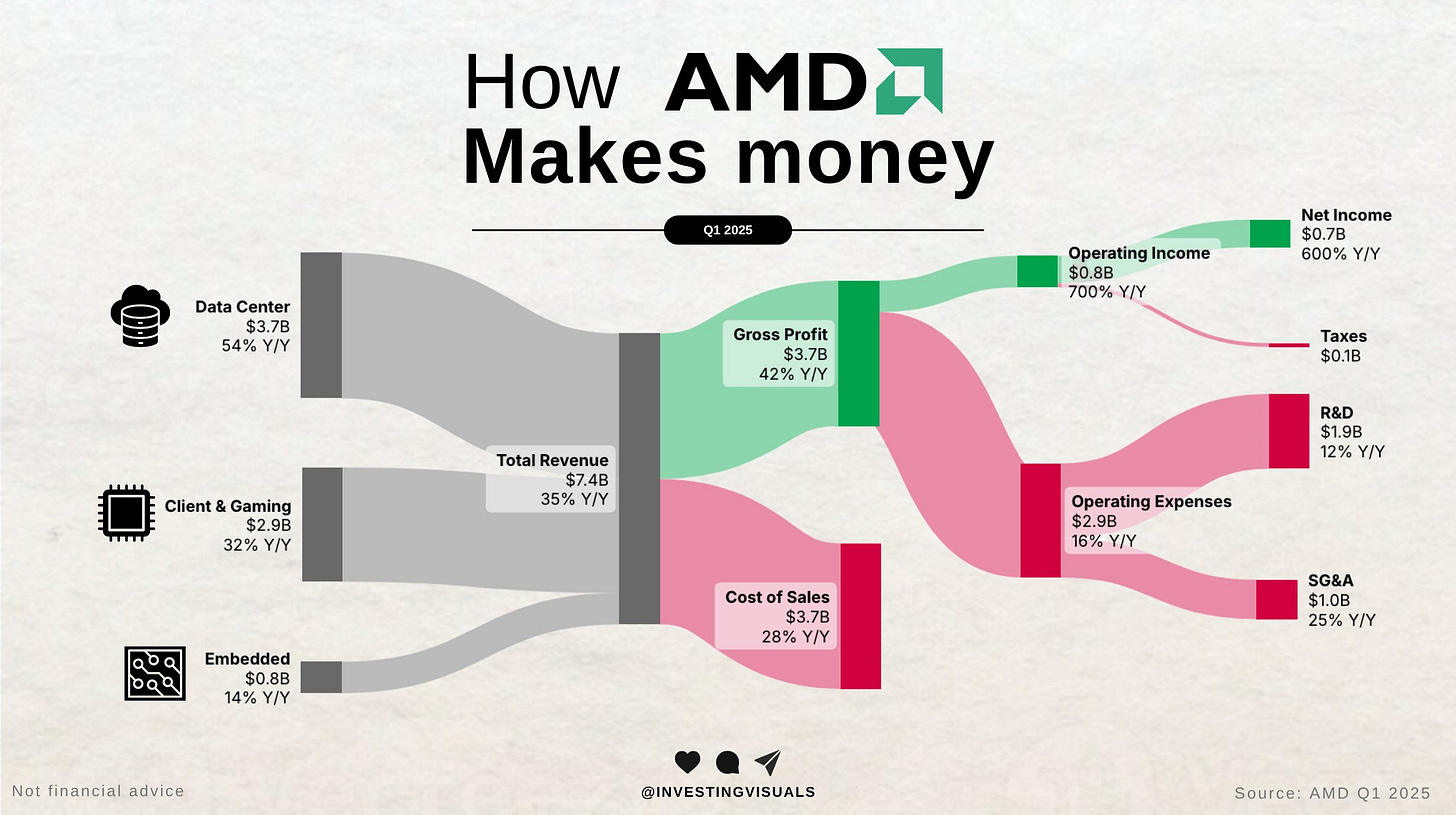

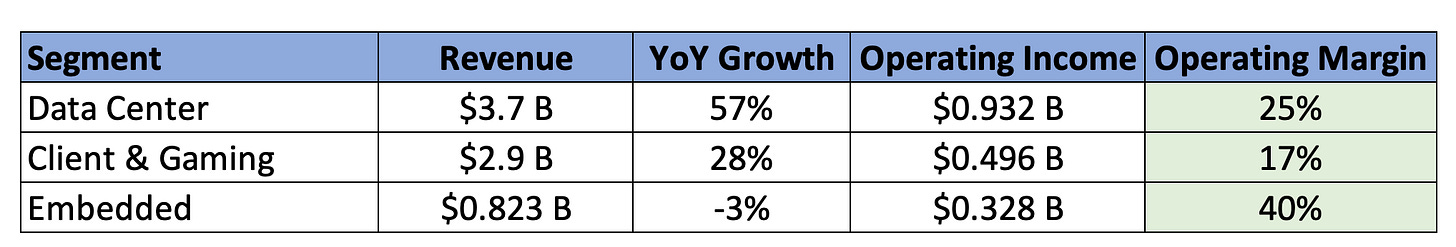

How they make money: Half of their revenue comes from data-center products, and the other half from PC chips, gaming products, and embedded devices. (Data as of Q1’25 earnings report)

PC processors (up 68% YoY): AMD’s Ryzen series CPUs (and APUs with integrated graphics) power desktops and laptops for consumers and businesses.

Server/Data Center Chips (up 57% YoY): AMD’s EPYC series server CPUs and Instinct accelerators (GPUs/AI accelerators) target cloud and enterprise data centers

Graphics & Gaming (down 30% YoY): AMD produces Radeon discrete GPUs for gaming PCs and workstations. It also supplies processors for game consoles (Sony PlayStation, Microsoft Xbox) and handhelds.

Embedded (down 3% YoY): Provides embedded CPU solutions for automobile, aerospace, and other specialized markets.

To the surprise of no one, selling shovels during a gold-rush meant that the stock has returned 26x that of the S&P 500 in the last 10 years!

What went wrong:

AMD is in a deep drawdown, having lost more than half its value from April 2024 to April 2025. This is in contrast to its competitor, NVDA, which has risen 26% over the last year. So, what happened?

In the Q2’24 earnings report, AMD’s gaming hardware revenue dropped by 59% due to a fall in demand for semi-custom chips used in PlayStation & Xbox.

Even though the revenue from AMD’s AI processors jumped 69% in Q4’24, it still missed the lofty expectations set by the analysts.

While the company continues to take market share from Intel in CPUs, it still lags behind Nvidia when it comes to GPUs (which are critical for powering AI/LLMs).

AMD’s MI-series accelerators struggled to gain traction against NVIDIA’s well-entrenched CUDA software ecosystem and superior performance, raising doubts about AMD’s ability to catch up in AI GPUs.

Rebound Catalysts

As we discussed in last week’s report, AMD has some strong catalysts. From its bottom in April, the company is now up 57% in the last 3 months.

AMD delivered a strong first-quarter earnings that beat expectations — revenue is up 36% YoY, and data center sales rose 57%. This suggests that AMD’s AI chips may finally be gaining traction.

The company launched its new Instinct MI350 series, which claims to have 60% more memory than Nvidia chips, and can create 40% more generated tokens for every dollar spent. If these numbers hold up in the real world, it could force AI data centers to diversify away from Nvidia sooner than expected.

AMD announced a $6 billion buyback program and a string of quick acquisitions focused on AI (Brium & Untether)

Rebound Potential

While strong catalysts are a good sign, here’s how AMD fares on our quality rubric:

1. Are the fundamental issues with the company cyclical or secular?

There are two aspects to this:

The PC/Gaming market slump was a classic cyclical correction. After the Covid driven demand boom in 2020-21 (when everyone was stuck at home), the PC industry saw a severe correction in 2022-23 due to excess inventory and weak consumer demand. Similar trends were noticed when AMD enjoyed a surge when the latest PS5/XboX launched followed by a lull as that cycle matured. This should pick up again with new game/console releases.

The second and more important question is whether AMD is competitive with Nvidia in the AI & high-end GPU market. Nvidia has a decade of head start with their CUDA architecture and has a significant moat both in hardware and software. AMD must close a substantial software and mindshare gap to truly compete for AI workloads. If (and its a big if) AMD’s new Instinct MI350 series can hold up its performance in the real world, it will take away a huge chunk of revenue from Nvidia.

2. Is the unit economics profitable?

After a small drop during 2023, AMD’s gross margins have improved to 50% as of the latest quarter. While in itself this is pretty good, it pales in comparison to Nvidia’s 70%! This finally comes down to Nvidia having a better product thereby having the ability to command a premium pricing.

If you move away comparing AMD to literally the most successful company in the world and view it on a standalone basis, they make good money in all segments they operate in.

3. How significant is the capital investment risk?

The capital investment risk is significant (but not in the way you think).

Unlike Intel, AMD does not own chip fabrication plants. It outsources manufacturing to foundry partners (primarily TSMC for leading-edge chips). This dramatically lowers AMD’s capital expenditure needs. They spent only a fraction of their revenue (<5%) on cap-ex mainly for equipment, testing, and facilities.

The capital risk comes in the form of intellectual capital.

AMD spends ~25% of their revenue in R&D every year! While high, this is the only way to stay ahead in this industry (If you are not convinced, check out what happened to Intel when they just waited a few years on the EUV Lithography).

For what its worth, AMD’s investments (Zen architecture development, Xilinx acquisition, etc.) have yielded strong returns so far.

4. How strong are the company’s financials?

AMD’s financials are in excellent shape. AMD is cash flow positive in operations and added $939M in Q1’25. Even after issuing $1.5 B of debt and $950 M commercial paper to close the ZT Systems deal (aimed at deepening rack-scale AI systems expertise), AMD still sits on net cash of roughly $3 B and has debt/EBITDA well below 1×.

Two things to watch out for are:

R&D is at ~25% of sales — While this is required, it pushes the profit leverage materially lower than Nvidia.

Inventory build-up — There was a 12% increase in inventory based on AMD’s latest earnings. A mis-forecast could force discounts or write-downs, denting future gross margin.

5. Is the management clear about the challenges?

Under CEO Dr. Lisa Su, AMD’s management has generally been transparent and realistic about the company’s challenges. At the June 2025 Advancing AI event, Lisa Su was upfront that AI is a critical focus for AMD’s future. She stated that AMD’s latest MI300X/MI350 GPUs can challenge NVIDIA’s chips and that the AI accelerator market could soar past $500 B in a few years.

Another positive is that Lisa Su’s management team has built credibility over the past 5+ years by consistently meeting or beating roadmap milestones (Zen CPUs, new GPU launches, integrating Xilinx, etc.).

6. Is the current valuation attractive?

At first glance, AMD (Trailing PE 101) is trading at 2x the PE ratio of Nvidia (Trailing PE 52), but this is due to not adjusting for Xilinx amortization. The Forward P/E is comparable, with AMD trading at 37 and Nvidia trading at 38. In other words, AMD is priced for growth, but not in a bubble territory relative to peers.

When the stock was trading at its bottom two months ago, the implied upside was much larger, but AMD still remains underpriced relative to its growth prospects (especially if you believe in their latest GPU chips). The market seems to be pricing in moderate success – leaving room for upside if AMD exceeds expectations, but also reflecting some execution risk.

So, where does that leave us?

It’s simple — Whether you invest or not in AMD finally comes down to just one thing: The performance of their new AI data center chips (Instinct MI350 series).

How we would trade this is very similar to our ASML strategy.

Get a small entry now (given the decent valuation and strong momentum) and then add or remove from the position based on real-world performance reports from AMD’s new AI data center chips.

To everyone who is concerned that Nvidia is too far ahead and too big for AMD to compete, don’t forget that AMD managed to beat Intel in processor performance.

Just 10 years ago, in 2015, Intel was worth $150 billion and AMD was worth only $2 billion. Today, AMD has 3x the market cap of Intel.

There is a lesson in that.

If you made it till the end, here is an interesting question:

If you found this interesting, please share this report with a friend.

Rebound Capital’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research

Love the coverage so far. I own many of these stocks, so I hope they continue to work.

Great coverage on AMD; absolute clarify on the thesis, thanks for sharing